Executive Overview

The Las Cristinas gold project in Venezuela is a significant case at the intersection of natural resource investment, sovereign risk, and international arbitration. Initially considered a premier undeveloped gold asset, its value was realized not through mining, but through legal enforcement against state-owned assets abroad.

Crystallex International is central to this transformation. After losing Las Cristinas, the company secured an arbitration award exceeding US$1.2 billion against the Republic of Venezuela, which is now being enforced through PDVSA’s ownership of CITGO in U.S. courts.

For investors, this case exemplifies how jurisdictional risk can outweigh asset quality and how distressed sovereign exposure can shift from physical assets to legal proceedings.

The Las Cristinas Gold Project (Asset Quality)

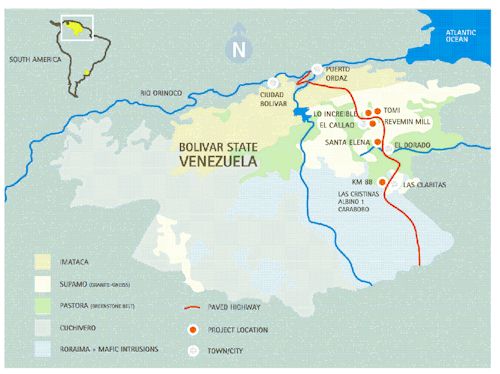

Las Cristinas is in Bolívar State, southeastern Venezuela, within the Km 88 mining district near Las Claritas, an area known for significant gold mineralization. The project’s location within or near the Imataca Forest Reserve later became a key political risk factor.

SEC-reported reserves and resources

According to Crystallex disclosures filed with the U.S. Securities and Exchange Commission (SEC)—principally its Form 20-F filings and the 2007 Mine Development Associates (MDA) Technical Report Update—Las Cristinas was reported as follows:

Proven and Probable Mineral Reserves

(Open pit; gold price assumption: US$550/oz)

- 464 million tonnes

- Average grade: 1.13 g/t gold

- Contained gold: ~16.86 million ounces

Additional Mineral Resources (exclusive of reserves; cutoff 0.5 g/t Au)

- Measured:

- 33.38 Mt @ 0.84 g/t → ~0.90 Moz Au

- Indicated:

- 131.64 Mt @ 0.71 g/t → ~3.00 Moz Au

- Measured + Indicated:

- 165.02 Mt @ 0.73 g/t → ~3.90 Moz Au

- Inferred:

- 229.63 Mt @ 0.85 g/t → ~6.28 Moz Au

Investment significance

From a purely technical standpoint, Las Cristinas qualified as a tier-one-scale gold deposit:

- Multi-decade mine-life potential

- Open-pit geometry

- Conventional processing assumptions

- Strong leverage to gold prices

Valuation Scenarios: In-Situ Gold vs. Realizable Value

From an investment standpoint, Las Cristinas presents a stark contrast between theoretical geological value and realizable economic value once sovereign risk is applied. The following scenarios illustrate how valuation collapses as political and enforcement risk increases.

Scenario 1: In-Situ Metal Value (Theoretical Upper Bound)

Using Crystallex’s SEC-reported proven and probable reserves of ~16.86 million ounces of gold, a simple in-situ valuation at various gold prices produces the following headline numbers:

| Gold Price (US$/oz) | Gross In-Situ Metal Value |

| $1,500 | ~$25.3 billion |

| $1,800 | ~$30.3 billion |

| $2,000 | ~$33.7 billion |

| $2,200 | ~$37.1 billion |

Interpretation:

This represents a geological endowment value only. It ignores capital costs, operating costs, taxes, royalties, dilution, time value, and—most importantly—sovereign risk. No serious investor would assign full in-situ value to a greenfield project.

Scenario 2: Conventional NPV (Low Sovereign Risk Jurisdiction)

In a stable jurisdiction (e.g., Canada, Nevada, Australia), analysts would typically apply:

- Long-term gold price: $1,600–$1,800/oz

- Discount rate: 5–8% real

- Capex: multi-billion-dollar initial build

- Mine life: 20–30+ years

Under such assumptions, a deposit of this size might plausibly support:

- After-tax NPV (5%): ~$4–8 billion

- After-tax IRR: mid-teens to low-20s

Interpretation:

This is the valuation range that originally justified Crystallex’s market capitalization and development strategy in the early 2000s.

Scenario 3: High Sovereign Risk Discount (Pre-Expropriation Reality)

By the late 2000s, Venezuela’s mining regime required investors to apply extreme discounts:

- Discount rate: 15–25%+

- Elevated political, permitting, and expropriation risk

- Uncertain fiscal terms and contract enforceability

Under these conditions, even a tier-one deposit could see:

- Risk-adjusted NPV: <$1–2 billion

- Binary downside: Total loss

Interpretation:

At this stage, Las Cristinas ceased to be a conventional mining investment and became a political risk bet.

Scenario 4: Post-Expropriation Valuation (Litigation Asset)

Once the mine was lost, Crystallex’s value no longer derived from gold ounces, but from its arbitration claim.

- ICSID award: ~US$1.2B

- With accrued interest: ~US$1.4B

Distressed and litigation-finance investors would typically value such claims at:

- 30–60% of face value, depending on:

- Enforceability

- Asset visibility

- Jurisdiction of enforcement

Implied claim valuation range:

➡ ~US$400 million to US$850 million

Scenario 5: Enforcement-Backed Valuation (CITGO Exposure)

The U.S. court finding that PDVSA is Venezuela’s alter ego fundamentally changed the valuation framework.

Because enforcement is now tied to CITGO Petroleum—a real, cash-generating U.S. asset—Crystallex’s claim moved closer to asset-backed recovery:

- Estimated enterprise value of CITGO (varies by cycle):

- ~US$10–13+ billion

- Multiple creditors competing for proceeds

- Recovery depends on priority, sale structure, and timing

Crystallex recovery scenarios (illustrative):

| Recovery Share | Implied Proceeds |

| 10% of sale | $1.0–1.3B |

| 15% of sale | $1.5–2.0B |

| 20% of sale | $2.0–2.6B |

Interpretation:

At this stage, Crystallex resembles a special-situations or distressed-credit investment, not a mining company. The upside is no longer tied to gold prices but to legal outcomes and creditor hierarchy.

Synthesis: Why Valuation Collapsed—and Re-Emerges Differently

Las Cristinas illustrates a rare valuation arc:

- Geology-driven valuation (gold ounces)

- Risk-adjusted mining valuation (NPV discounting)

- Binary political loss (expropriation)

- Legal claim valuation (arbitration award)

- Asset-backed enforcement valuation (CITGO)

For investors, this case demonstrates that sovereign risk does not eliminate value—it transforms it. Capital did not disappear; it migrated from the ground into the courtroom.

Investor Takeaway

Las Cristinas was never monetized through mining—but it may ultimately generate value exceeding what many producing mines deliver, purely through enforcement of sovereign accountability.

At prevailing gold prices today, this reserve base would imply tens of billions of dollars of in-situ metal value before jurisdictional discounting.

Crystallex’s Investment Thesis and Failure Point

Crystallex was awarded the Las Cristinas development contract in 2002 and advanced the project through feasibility-level work. Capital markets initially valued the company as a large emerging gold developer, with Las Cristinas as its cornerstone asset.

However, in 2008, Venezuela denied the project’s final environmental permit despite years of technical progress. In 2011, the Venezuelan state formally terminated Crystallex’s contract, eliminating the company’s only producing pathway.

This moment marked the collapse of the traditional mining investment thesis and the beginning of a legal-asset recovery strategy.

International Arbitration: From Mine to Claim

Crystallex initiated arbitration under a bilateral investment treaty, arguing unlawful expropriation and denial of fair and equitable treatment.

In 2016, an ICSID Additional Facility tribunal ruled in Crystallex’s favor, awarding approximately US$1.2 billion, later accruing interest to roughly US$1.4 billion.

Critically for investors:

- The award was against the Republic of Venezuela, not against a state-owned company.

- Venezuela refused to pay, forcing Crystallex into global enforcement mode.

The investment exposure had now shifted from gold price risk to sovereign credit and enforcement risk.

Enforcement Strategy and U.S. Jurisdiction

Crystallex sought enforcement in the United States, where Venezuelan-linked commercial assets existed and courts were willing to recognize arbitration awards.

U.S. federal courts confirmed the award and permitted Crystallex to pursue non-immune assets connected to Venezuela.

This led directly to litigation involving PDVSA, Venezuela’s national oil company.

PDVSA as Venezuela’s Alter Ego

In a pivotal 2019 decision, the U.S. District Court in Delaware ruled that PDVSA functioned as an “alter ego” of the Venezuelan state. This finding meant:

- PDVSA’s assets could be used to satisfy Venezuela’s debts

- Corporate separateness would not shield PDVSA from enforcement

- State-owned enterprises could be treated as extensions of sovereign policy

This ruling fundamentally altered how investors assess state-owned enterprise risk in emerging markets.

CITGO: The Enforcement Asset

PDVSA owns PDV Holding Inc. (PDVH), which in turn owns CITGO Petroleum, one of the largest independent refiners in the United States.

Crystallex targeted PDVH shares, making CITGO the effective collateral for Venezuela’s unpaid obligations.

For investors, this represented:

- A rare case of strategic energy infrastructure exposed to foreign sovereign debt

- A precedent for using equity seizure rather than asset foreclosure

- A shift from resource nationalism to resource-backed enforcemen

Judicial Sale and Creditor Competition

Between 2023 and 2025, the Delaware court authorized a judicial sale process overseen by a Special Master. Multiple creditor classes now compete for proceeds, including:

- Crystallex

- Venezuela sovereign bondholders

- Other arbitration award holders

The process remains ongoing, with disputes over:

- Valuation

- Bid structure

- Priority of claims

No final sale has closed as of late 2025, but the trajectory points toward partial or full transfer of PDVH/CITGO ownership.

Crystallex Today: Ownership and Asset Profile

Crystallex was delisted from the TSX and NYSE Amex in 2012 and no longer trades publicly.

Today, Crystallex is:

- Privately held

- Owned by a small group of legacy shareholders and financial stakeholders

- Economically defined by its judgment enforcement rights, not mining assets

The company functions less as a miner and more as a special-situation litigation vehicle.

Investment Lessons

The Las Cristinas case offers several enduring lessons:

- Tier-one geology does not offset sovereign risk

- State-owned enterprises may not protect investors from enforcement

- Arbitration awards can become tradeable, financeable assets

- Jurisdictional risk can persist for decades after expropriation

For emerging-market investors, Las Cristinas stands as a case study in the monetization of political risk.

Conclusion

Las Cristinas will likely never be remembered for gold production. Instead, its legacy lies in reshaping how investors, courts, and governments understand resource expropriation, sovereign accountability, and cross-border asset enforcement.

What began as a mining project ultimately evolved into one of the most important sovereign-risk cases of the 21st century—demonstrating that in global capital markets, law can be as valuable as ore.

References

- Crystallex International Corporation. Form 20-F Annual Reports (2007–2011). U.S. Securities and Exchange Commission.

- Mine Development Associates. Las Cristinas Project Technical Report Update (2007).

- ICSID Additional Facility Arbitration: Crystallex International Corp. v. Bolivarian Republic of Venezuela (2016).

- U.S. District Court for the District of Delaware. Crystallex v. PDVSA / PDVH enforcement proceedings (2019–2025).

Leave a comment